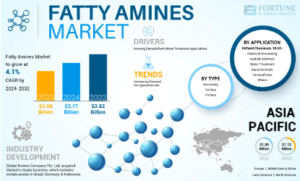

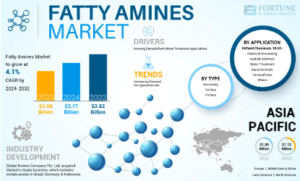

The global fatty amines market size was valued at USD 2.68 billion in 2023. The market is projected to grow from USD 2.77 billion in 2024 to USD 3.82 billion by 2032, exhibiting a CAGR of 4.1% during the forecast period.

Fatty amines are a diverse group of oleochemicals derived from natural oils and fats. These compounds exhibit exceptional surfactant properties, making them valuable in various industries. They are categorized into primary, secondary, and tertiary fatty amines. Notable examples include oleylamine, soya amine, tallow amine, and coco amine. These products have a broad range of applications across industries, such as agrochemicals, oilfield chemicals, chemical processing, water treatment, asphalt additives, personal care, which will significantly contribute to the market’s growth.

Fortune Business Insights™ displays this information in a report titled, "Fatty Amines Market, 2024-2032".

LIST OF KEY COMPANIES PROFILED IN THE REPORT:

- Clariant (Switzerland)

- AkzoNobel (Netherlands)

- Global Amines (Singapore)

- Kao Chemicals Global (Japan)

- Evonik Industries Ag (Germany)

- Arkema (France)

- Nouryon (Netherlands)

- Vantage Leuna GmbH (U.S.)

- Indo Amines Limited (India)

- Huntsman International LLC. (U.S.)

- Ecogreen Oleochemicals (Singapore)

Segmentation:

Tertiary Amines Widely Used Due to Significant Demand Across Various Industries

Based on type, the market is segmented into primary, secondary, and tertiary. The tertiary segment accounted for the largest market share in 2023 and is expected to maintain its dominance during the forecast period. The significant demand for tertiary amines across various industries, driven by their diverse applications, such as fuel additives, ore floatation, corrosion inhibitors, and chemical intermediates, contributes to their market dominance.

Agrochemicals Segment to Dominate Market Owing to Increased Demand for Food Grains

Based on application, the market is segmented into agrochemicals, oilfield chemicals, chemical processing, water treatment, asphalt additives, personal care, and others. The agrochemicals segment held the leading position in the market as the shift in global climate has made crops more vulnerable to insects and fungi. As the population grows and agricultural land becomes scarcer, a demand-supply gap emerges for food grains.

The market is studied regionally across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Report Coverage:

The report has conducted a detailed study of the market and highlighted several critical areas, such as leading companies, sources, and prominent product applications. It has also focused on the latest market trends and highlights vital industry developments and market outlook. Apart from the aforementioned factors, the report has given information on many other factors that have helped the market grow.

Drivers and Restraints:

Increasing Demand for Water Treatment Applications to Drive Market Growth

Water availability varies significantly across the globe, with some regions experiencing water scarcity. The confluence of industrialization and water pollution aggravates this issue. Fatty amines are extensively employed in water treatment processes, particularly in wastewater treatment by refineries, industrial plants, and the processing industries.

The global water supply has experienced considerable pressure in recent years due to rapid expansion of the global population. The escalating requirement of clean water in industrial settings and the far-reaching impacts of climate change, which has led to a global water scarcity, are fueling the demand for products designed for water treatment applications.

However, the presence of sustainable and environmentally friendly economical alternatives may impede the fatty amines market growth during the forecast period.

Information Source: https://www.fortunebusinessinsights.com/fatty-amines-market-102901

Regional Insights:

Asia Pacific Dominated Market Due to Rising Consumer Expenditure

Asia Pacific accounted for the largest fatty amines market share globally propelled by the product demand for personal care applications. Additionally, the increasing industrialization is fueling the need for fatty amines in oilfield chemicals, chemical processing, asphalt additives, and other applications.

North America and Europe are experiencing substantial growth and expected to witness considerable gains in the coming years. Significant investments being made in the water and wastewater treatment industries within these regions are expected to drive the demand for fatty amines in the future.

Competitive Landscape:

Key Players to Focus on Expanding Their Production Capacity to Meet Increasing Product Demand

The key players operating in this market include Arkema, Nouryon, Global Amines, AkzoNobel, Kao Chemicals Global, Clariant, Evonik Industries Ag, and others. These companies are also adopting strategies such as expanding their production capacity to cater to the increasing demand in the market.

Notable Industry Development:

February 2022: Kao Corporation announced the construction of a new tertiary amine production unit in the U.S. to meet the growing demand for sterilizing and cleaning applications and various industrial applications. The new unit will enhance Kao’s supply chain in the U.S. market.

SURVEY

How Did You Hear About Us?

SURVEY

How Did You Hear About Us?

Comments